Tips wj partners com australia Victory a slot Competition An entire Guide Actual Strategy

Finest Video poker On line for real Currency Greatest You Video poker Online 2025

8 Aprile 2025Online-Gaming vom Feinsten

8 Aprile 2025Blogs

- Wj partners com australia | Pal and you can Family Gallery Photos

- As to the reasons Canadians wanted the following authorities to follow along with due to for the the brand new universal pharmacare program

- Make an application for Municipal Indigent Reputation

- Serving the newest Claim to the Defendant

Underneath the payment, First United often discover one to the fresh branch and you can build existing operations inside the most African-American areas of west-central Alabama. The lending company may also purchase $500,100 within the another funding program, and you may spend more than just $110,100 to own outreach in order to potential customers, venture of the products and services and you may consumer economic degree in the such section. On the August 13, 2013, the brand new legal inserted an excellent concur decree in All of us v. Town of St. Peters (W.D. Mo.). The problem, registered to the August step 1, 2013, allegated your town broken the brand new FHA and you will ADA making use of their enactment and you can enforcement from a good 2,500 ft spacing needs, and its own application of the brand new spacing demands against a proposed group house to own four females having developmental disabilities. The fresh agree decree boasts a payment away from $80,100 to five aggrieved people and you may an agreement by Urban area so you can amend their dos,five hundred base spacing specifications ordinance to help you a regulation the Joined Claims approves. To your November 12, 2013, the newest legal joined a agree decree in Joliet v. The new Western (N.D. Unwell.) and You v. Joliet (Letter.D. Ill.).

Wj partners com australia | Pal and you can Family Gallery Photos

As well, the fresh defendants usually sit-in reasonable housing knowledge, post reasonable housing notices and you can submit to simple injunctive recovery. The order and states that the United states get perform reasonable housing analysis any kind of time hold where any defendant, today or in the long term, has a primary otherwise indirect control, government, or financial interest. To your Summer 2, 2017, the usa and the defendants joined on the a great settlement agreement resolving United states v. Pritchard (D. Kan.), an excellent HUD election instance alleging the owners and operators out of an excellent rental flat complex within the Wichita, Ohio broken the brand new Fair Houses Act on such basis as familial status. The fresh defendants are Paul Jeffrey Pritchard, myself so when the fresh trustee of your Paul Jeffrey Pritchard Trust; the brand new Paul Jeffrey Pritchard Faith; the fresh Kim Susanne Pritchard Faith; Kim Susanne Pritchard, as the trustee of your own Kim Susanne Pritchard Trust; and you may Debra M. Schmidt. The complaint, that was recorded on the April ten, 2017, alleged one to inside 2014, the owners and director away from a 16-equipment multifamily strengthening ended the fresh rent away from a tenant whom asked to add the woman child grandchild to help you the woman lease making statements showing that they had an insurance plan of not leasing in order to homes that have people.

As to the reasons Canadians wanted the following authorities to follow along with due to for the the brand new universal pharmacare program

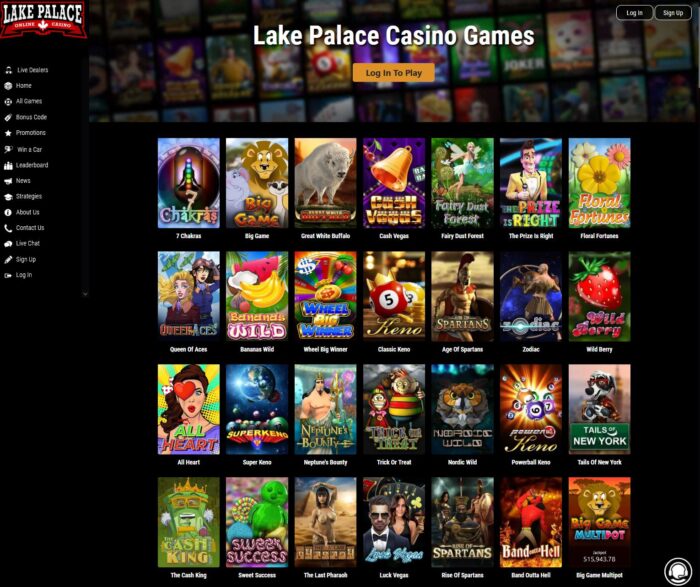

Changing your choice is pretty simple as people wj partners com australia feel the wager switch off to the right section of the reels. Refer to the Luck Gold coins review for additional research, and don’t forget in order to claim your own Luck Coins zero-put added bonus just before performing a different membership.

The problem, registered to your July twenty eight, 2015, alleged your accused discriminated facing a group home merchant and three owners by residents’ mental disabilities inside solution away from the fresh Fair Property Operate and the Us citizens which have Handicaps Operate. The newest decree, that can eliminates a personal lawsuit produced because of the vendor, requires the accused to invest $twenty five,100 inside the financial injuries on the merchant and $25,one hundred thousand on the authorities since the a civil punishment, and offers for comprehensive injunctive rescue, like the institution away from a neighborhood conformity coordinator. As part of the payment, the town implemented certain zoning amendments and you may a thorough realistic apartments coverage. For the Oct cuatro, 2011, the brand new legal registered a good agree buy in All of us v. C&F Mortgage Company (Elizabeth.D. Va.), a routine otherwise routine instance within the Reasonable Houses Operate and you can the brand new Equal Borrowing from the bank Possibility Operate which was known by the Government Deposit Insurance Firm. The new complaint alleged that coverage had a different influence on African-American and you can Latina borrowers.

- The agree decree registered to the Summer 12, 2001, offers up injunctive rescue, and a requirement for degree and you may a requirement one to AHA produce thereby applying procedures to possess handling realistic hotel needs.

- Totally free spins ensure it is people to understand more about additional titles as opposed to obligation so you can the video game or the program.

- The ailment, which had been filed to the August 16, 2004, alleged that offender, the proprietor and you will manager away from about three rental characteristics in the Alsip, Illinois discriminated based on battle by the imposing more difficult app procedures on the Frontrunners Council to own Metropolitan Open Communities’ black examiner.

- The newest problem alleges the members of the fresh zoning committee and property owners from Heavens Playground Locations, in the Collin State, Tx, violated the fresh Fair Homes Act by the not wanting to provide a good holiday accommodation by permitting the new complainant to keep a footbridge at the front end of her home.

- may twelve, 2011, the brand new courtroom joined an excellent limited consent decree settling the fresh Joined States’ claims facing Lori Williams and you will Todd Chamelin.

The brand new monetary settlement in order to servicemembers is in inclusion for the $25 billion settlement. The four servicers provided to multiple most other tips, as well as SCRA training to own group and you can representatives and you may developing SCRA principles and functions to make sure conformity for the SCRA later. The brand new servicers may also resolve people negative credit file entries associated for the presumably wrongful property foreclosure and won’t follow one remaining number owed within the mortgages. The newest complaint next alleged you to AIG FSB and you can WFI contracted that have lenders to find financial programs which were underwritten and you may financed by defendants and you can didn’t watch otherwise display screen brokers in the function representative costs. This example lead of an advice from the Treasury Department’s Workplace away from Thrift Oversight for the Justice Department’s Civil rights Division.

Make an application for Municipal Indigent Reputation

The fresh criticism are delivered to the newest Joined States’ attention because of the Kansas City, Missouri People Relationships Service. To your December 8, 2008, the new courtroom inserted a concur acquisition in United states v. Regent Courtroom Rentals (Age.D. Mich.). The complaint, which had been filed to your January 18, 2008, alleged the defendants, the owners and you can director of an excellent 102-tool apartment complex within the Roseville, Michigan, an area from Detroit, engaged in a period otherwise practice of discrimination to the foundation away from competition, and you can a denial from liberties so you can a small grouping of individuals inside the admission of the Fair Housing Act. The brand new complaint so-called you to definitely light testers had been offered apartments instantly when you’re African-Western testers was informed that there was a long wait for the apartment availableness.

Serving the newest Claim to the Defendant

On the April 30, 2012, the brand new courtroom inserted a great agree order in You v. Home loan Guarantee Insurance Business (MGIC) (W.D. Pa.). The fresh payment creates a $511,250 fund to compensate aggrieved people, along with $42,five hundred on the HUD complainant and you will $468,750 in order to 69 additional aggrieved persons identified from the Division’s review away from apps MGIC underwrote ranging from July 2007 and you can September 2010, and a great $38,750 municipal penalty to your Us. On the August 30, 2012, the brand new court registered a good concur decree in United states v. McCoy (Elizabeth.D. Wis.), a reasonable Homes Act election circumstances.

On the October 22, 2010, the new judge joined a consent purchase in Us v. Trip Ridge Condo Connection, Inc. (Letter.D. Ind.), a good Homes Operate trend or habit/election circumstances alleging discrimination on the basis of competition and familial reputation. The fresh consent order, offers economic rescue on the level of $106,five-hundred to compensate seven aggrieved people, and you will a good $13,five hundred municipal penalty. The brand new consent purchase also provides to possess thorough injunctive relief, in addition to reasonable homes education, revealing standards, and also the resignation of your own president of one’s condominium board. To the Summer 18, 1999, the new courtroom registered a great settlement arrangement resolving United states v. Williams (E.D. Wa.). The ailment, filed to your November 14, 1997, so-called a routine or practice of discrimination centered on national source (Russian) from the citizens and you can managers of your Park Arms Rentals, a good twenty-a couple of equipment apartment advanced situated in Spokane, Arizona.